Earlier this week, we reported on The New York Times’s “deficit puzzle,” which allows you to close both the short-term and long-term budget gaps for the years 2015 and 2030 using cuts to domestic and defense spending, Medicare and Social Security reform, or tax increases.

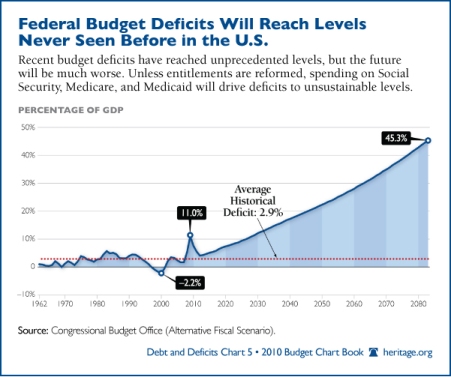

We used the puzzle to close the long-term budget gap completelywhile also extending the 2001 and 2003 tax cuts—using only the available spending cuts. Though deficit reduction must occur immediately, long-term deficits are the real crux of the matter. In 2030, the federal deficit will be more than 10 percent of gross domestic product and will continue to climb to unprecedented levels. If tax hikes alone were used to pay for spending on Medicare, Medicaid, and Social Security, in 2050, the lowest income tax rates would rise from 10 percent to 19 percent. The middle income bracket would see a hike from 25 to 47 percent, and the highest income rates would go from 35 to 66 percent. And rates would continue to climb to meet increasing levels of spending. This level of taxation is unsustainable, which is why spending reduction is the only plausible solution.

Some, however, would prefer to maintain spending on bloated federal programs and instead close the budget gap by raising taxes and “soaking the rich.” In a recent New York Times article, David Leonhardt describes several ways to achieve this using the puzzle. He suggests allowing the 2001 and 2003 tax cuts to expire for incomes above $250,000, enacting a 5.4 percent surtax on millionaires’ income, and restoring the estate tax, capital gains, and dividends to Clinton-era levels. In addition, he lifts the cap on the Social Security portion of the payroll tax, reduces the Social Security benefits for high-earners, reduces the number of tax deductions for high-income households, and enacts a bank tax.

What would be the result? According to Leonhardt, “you’d get about $570 billion of the $1.3 trillion in needed deficit savings for 2030—or 43 percent.”

In fact, selecting all of the options to increase taxes—including the crippling carbon and national sales taxes, which would hit all Americans—would still leave a deficit in 2030.

Furthermore, these projections do not account for the effect of growing levels of taxation on the economy. As Guinevere Nell and Karen Campbell, Ph.D., economists in Heritage’s Center for Data Analysis, write, “When tax increases reduce economic growth or create incentives for taxpayers to evade taxes, they bring in less revenue than a static (purely accounting) projection would predict.” So increasing taxes to close the budget gap would be even less effective than the deficit puzzle shows.

Not to mention, as Nell and Campbell show, higher taxes on the rich would slow the economy. A slower growing economy would reduce the number of jobs available and the wages of those employed. This would hurt Americans at all income levels.

To reduce the deficit, Congress needs to address the root of the problem, not the symptoms. The only way to restore permanent solvency to entitlement programs and reduce deficit spending on other federal programs is to reduce spending.

No comments:

Post a Comment